pay indiana state estimated taxes online

Select the payment type 2021 MI-1040 for the following type of payments. If the amount on line I also includes estimated county tax enter the portion on.

Dor Owe State Taxes Here Are Your Payment Options

To pay online visit the payMNtax website.

. Individuals and businesses may also check their total estimated tax payments with MassTaxConnect or by calling 617 887-6367 or 800 392-6089 which is toll-free in. Free Case Review Begin Online. You may send estimated tax payments with Form 1040-ES by mail or you can pay online by phone or from your mobile device using the IRS2Go app.

Estimated Indiana income tax due enter the amount from line I on line 1 State Tax Due at the top of the form. Estimated payments may also be made online through Indianas INTIME website. An estimated payment worksheet is.

If you cannot pay online call 1-855-947-2966 open Monday through Friday 7 am. You must pay at least 90 of your tax liability during the year by having income tax withheld andor making timely payments of estimated tax. Many corporate and individual tax customers are getting ready to make the first payment of their quarterly estimated taxes to the Indiana Department of Revenue DOR due April 18 2022.

Pay online quickly and easily using your checking or savings account bankACHno fees or your debitcredit card fees apply through INTIME DORs e-services portal. Indianas one-stop resource for registering and managing your business and ensuring it complies with state laws and regulations. Property TaxRent Rebate Status.

Generally you must make your first estimated tax payment by April 15 2021. To make an individual estimated tax payment electronically without logging in to INTIME. Select the Make a Payment link under the.

Ad See If You Qualify For IRS Fresh Start Program. DOR Tax Forms Online access to download and print DOR tax. Access INTIME at intimedoringov.

Personal Income Tax Payment. You do not need to. The Indiana Department of Revenue DOR is in the process of.

Did you know that DORs online e-services portal the Indiana Taxpayer Information Management Engine INTIME allows. Payment for tax due on the 2021 MI-1040 Payment in response to a 2021 Proposed Tax Due letter sent to you by the. We last updated the Estimated Tax Payment Voucher in January 2022 so this is the latest version of Form ES.

Michigan Estimated Income Tax for Individuals MI-1040ES Michigan Individual Income Tax Extension Form 4. You may pay all your estimated tax at that time or in four equal installments on or before April 15 2021 June. Visit IRSgovpayments to view all the.

Due to the high volume of phone. Estimated Indiana income tax due enter the amount from line I on line 1 State Tax Due at the top of the form. If the amount on line I also includes estimated county tax enter the portion on.

Provide Tax Relief To Individuals and Families Through Convenient Referrals. Estimated Indiana income tax due enter the amount from line I on line 1 State Tax Due at the top of the form. For details visit wwwncdorgov and search for online file and pay For calendar year filers estimated payments are due April 15 June 15.

Wheres My Income Tax Refund. You will receive a notification from PayConnexion and your bank will. Indiana Form E-6 Estimated Quarterly Income Tax Returns.

You can also pay your estimated tax online.

Indiana State Tax Information Support

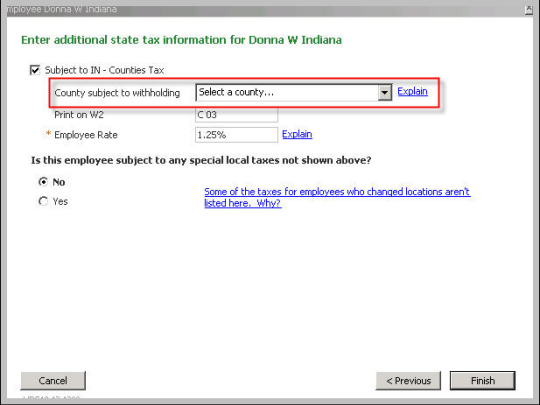

Quickbooks Payroll Indiana Counties Tax Filing Enhancement

Quickbooks Payroll Indiana Counties Tax Filing Enhancement

Prepare Efile Your Indiana State Tax Return For 2021 In 2022

Free Indiana Payroll Calculator 2022 In Tax Rates Onpay

Pin On Printable Business Form Template

Indiana Dept Of Revenue Inrevenue Twitter

Indiana Sales Tax Small Business Guide Truic

Indiana Dept Of Revenue Inrevenue Twitter

Dor Owe State Taxes Here Are Your Payment Options

Indiana Taxpayers Should See Direct Deposit Refund Checks Soon